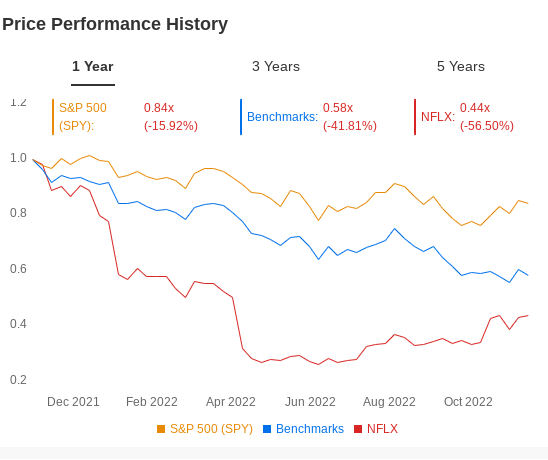

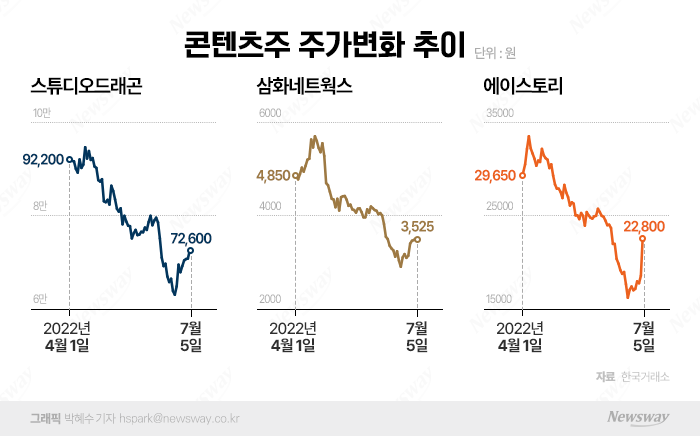

Netflix (NFLX) is at least showing signs of a comeback, a bullish analyst said.I think it’s back to growth,” Santosh Rao, head of research at Manhattan Venture Partners, told Yahoo Finance Live (video above). “At the moment we are doing everything out of a bullish stance.Because the big concerns were as follows. Are they jumping into this advertising model out of weakness? Is their entire business model not working?” The company’s third-quarter earnings report showed a beat on both the top and bottom lines, as well as 2.41 million subscribers.”This shows that everything is working,” Rao said. They’re just laminating on a different layer of revenue streams……it seems to be going well. I think Netflix is back, so to speak.”The reason we’re expecting Tuesday’s earnings is because the company added subscribers for the first time this year, mainly from outside the United States.Netflix saw its subscribers drop by 200,000 and 970,000 in the first and second quarters, respectively. The company has announced it will suspend future guidance for paid members with the introduction of a new revenue stream. For now, however, 4.5 million subscribers are expected to be added next quarter (over 3.9 million originally estimated).He added in particular:”I don’t know how many people will win the advertising class. There will be many moves within their subscriber base. I don’t know where the chip will fall. We believe that adding this layer of advertising will only gradually add to the positive.And it will be a good backstop for those who want to leave the platform.”Like Rao, most analysts remain bullish on the profitability of new advertisers,” he said when asked about the company’s decision to end guidance.UBS analyst John Hodulik recently raised his stock price target by $52-250 per share, while JP Morgan analyst Doug Anmuth said the cut in advertising fees ($6.99 in the U.S.) showed confidence in Netflix’s advertising revenue.Elsewhere on Wall Street, Citigroup analyst Jason Bazinet, who maintains a Buy valuation on stocks, says the next tier of ads could show “material gains” in free cash flows, and Evercore ISI’s Mark Mahaney expects ad support to grow between $1 billion and $2 billion by 2024.”Advertising potentially brings a new user base that we didn’t previously subscribe to,” he added.”And this game could have a lot of revenue.”Before the announcement of advertisers, Jeremi Gorman, president of Netflix Worldwide Advertising, said the platform had “almost sold out” around the world for launch, reversing a slowdown in global advertising spending.Despite falling FX headwind returns, Netflix continued to strengthen the U.S. dollar against most major currencies and lowered its futures guidance due to the foreign exchange headwind.”Based on YTD’s performance and Q4 guidance, we estimate that this increase since January 1, 2022 will have a negative impact on full-year earnings and operating profit of ~$1 billion and $0.8 billion, respectively,” the company said in its earnings release.According to Rao, this could hamper Netflix’s resurgence. “International growth is an important aspect of overall growth.” The impact of FX will be very significant, and if there is a slight error in the 4Q number, the impact of FX can be considered. They probably want to be conservative in terms of predicting 4Q estimates and 4Q guidance. “But overall, I think the dollar’s strength is a big negative.”

Netflix (nitrogen FL ) at least showing signs of a comeback concert, that it’s bullish analysts said.Manhattan, Venture Partners responsible for the research policy · Sainte-Foy rao live (showing) Yahoo Finance said in an interview with 「 growth once again I think 」 he said. 「 it is now a strong position in all is being carried out. why is a big concern is as follows : . Through the ad system model since they were relatively weak position on one hand? their business model doesn’t function as a whole?「 A report on the 241 million the company’s third quarter results as well as subscribers both in the high-order and low-order bit.According to the Lao, everything is showing to be functioning. 「 I’m only by layering on different floors in a source of revenue. Everything is going well. In other words, it was Netflix has again come in the saddle.「 」 the results of Tuesday the reason for the company to the subscriber for the first time earlier this year added, but most came from an area outside the United States. Netflix and in the second quarter of the first quarter lost 200,000 subscribers, 97 million. The company, the introduction of new earnings stream for paid memberships for guiding, disrupted by he said. However the time being, the estimated 4.5 million subscribers in the next is added (from the previous forecast of as low as three million).

Netflix “does everything from a powerful standpoint now,” analysts say. At least according to one bullish analyst, Netflix is back at the top.yahoo.com

Netflix “does everything from a powerful standpoint now,” analysts say. At least according to one bullish analyst, Netflix is back at the top.yahoo.com